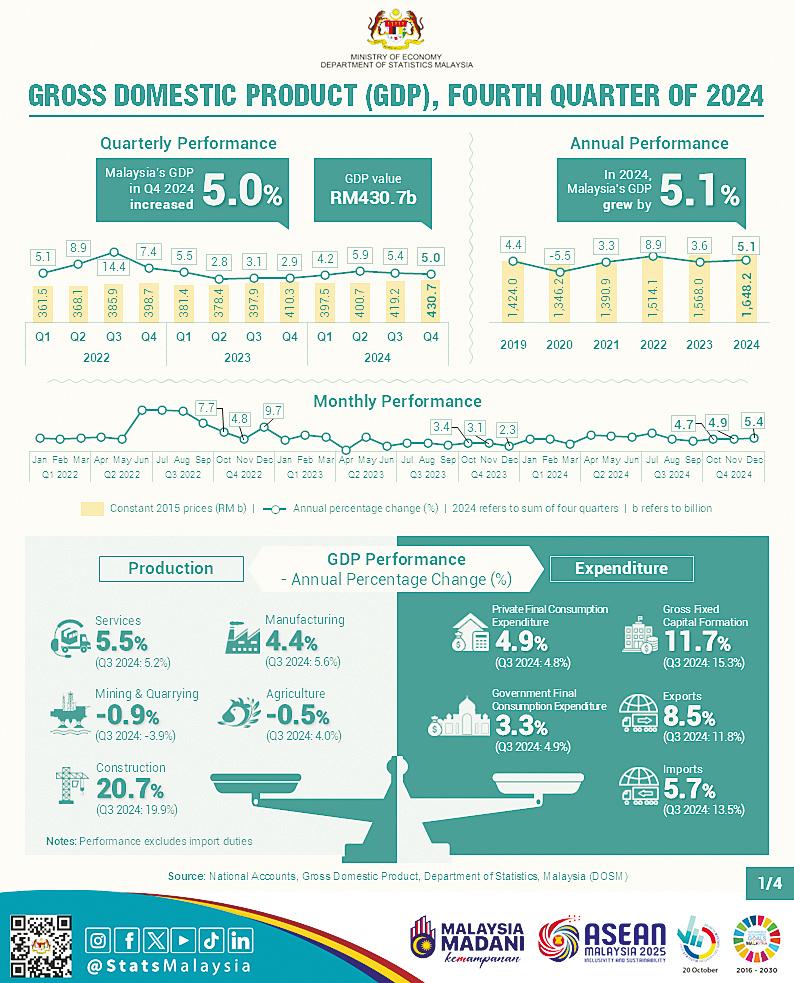

PETALING JAYA: Malaysia’s gross domestic product (GDP) in the fourth quarter of 2024 grew by 5% compared to 5.4% in the third quarter of 2024.

However, on a quarter-on-quarter seasonally adjusted basis, GDP contracted by 1.1% for the last three months of 2024 (Q3: up 1.9%)

In Q4 2024, the Malaysian economy grew at 4.7% and 4.9% in October and November, respectively, before accelerating to 5.4% in December. Hence, Malaysia’s economic performance increased to 5.1% in 2024 compared to 3.6% in the previous year.

Chief Statistician Malaysia Datuk Seri Dr Mohd Uzir Mahidin said, “The economic growth of 5% was driven by the positive momentum of all key sectors except for agriculture and mining & quarrying sectors which declined in the fourth quarter of 2024. The substantial investment inflows into key sectors, coupled with easing inflationary pressure and improving labour market with near-decade low unemployment rates, have stimulate the domestic demand, thus strengthening the nation’s growth trajectory.”

The services sector expanded by 5.5% in the fourth quarter of 2024 (Q3: 5.2%). The performance was propelled by the wholesale & retail trade sub-sector at 4.4%, following growth in all segments namely wholesale trade (5.4%), retail trade (4.1%) and motor vehicles (2.2%).

Additionally, the transport & storage sub-sector showed a better growth in this quarter at 10.7%. These gains were fuelled by resilience in consumer spending during the year-end festive season and school holidays that contributed to the continued recovery in tourism-related industries. On a quarter-on-quarter seasonally adjusted basis, the services sector fell 0.8% (Q3: up 1.7%).

The manufacturing sector’s growth moderated to 4.4% (Q3: 5.6%) in the fourth quarter, driven by the growth in export-oriented industries such as electrical, electronic & optical products (7.3%) and petroleum, chemical, rubber & plastic products (3.2%) due to higher external demand. Nonetheless, domestic-oriented industries grew at a slower pace, influenced by transport equipment, other manufacturing and repair following lower production in motor vehicles and transport equipment. On a quarter-on-quarter seasonally adjusted, the manufacturing sector decreased by 2.8% (Q3: 2% growth).

The construction sector accelerated further to 20.7% (Q3: 19.9%), marking its fastest expansion since the second quarter of 2021. All segments displayed robust growth led by non-residential buildings (23.9%), particularly data centre-related projects in Johor and Selangor. This was followed by specialised construction activities (23.6%), residential buildings (30.3%) and civil engineering (9.1%).

The growth indicates ongoing demand for renovation, maintenance and specialised construction projects across residential, commercial and industrial segments as well as a surge in infrastructure development projects, such as offshore platform installation and highways. Quarter-on-quarter seasonally adjusted, this sector decreased 2.3% (Q3: 5.7% growth).

In addition, the agriculture sector declined 0.5% (up Q3: 4%), owing to a 5.3% decrease in the oil palm sub-sector. Nonetheless, the 3% growth in the livestock sub-sector and the strong 23.3% expansion in the rubber sub-sector helped eased the impact of the contraction in the agriculture sector. The sector registered a decline of 1.8% on a quarter-on-quarter seasonally adjusted basis (Q3: 0.5%) .

The mining and quarrying sector declined 0.9% in the fourth quarter (Q3: -3.9%), influenced by a contraction in the crude oil and condensate sub-sector of 6.2%. Nevertheless, the natural gas sub-sector rebounded to 2.4% growth, supported by recovery in gas production during the quarter. This sector’s growth expanded to 5.9% (Q3: -1.1%) in quarter-on-quarter seasonally adjusted terms.

Gross fixed capital formation or investment in fixed assets, registered 11.7% increase (Q3: 15.3%), extending its double-digit growth for the third consecutive quarter.

Malaysia’s economy in 2025 is expected to remain resilient, driven by strong labour market conditions, robust exports in the electrical and electronics sector and implementation of key investment initiatives. Private consumption will be boosted by the implementation of a minimum monthly wage increase to RM1,700 starting this month,

Public Service Remuneration System adjustments with an allocation of RM10 billion, along with the implementation of the Progressive Wage Policy, with a RM200 million allocation benefiting 50,000 workers.