PETALING JAYA: Malaysian businesses and national-level economic groups are scrambling to assess the broader damage from the United States’ 25% tariff on Malaysian products that is set to go into effect on Aug 1.

The tariff is part of a wider US push to reshore manufacturing and limit dependence on strategic imports.

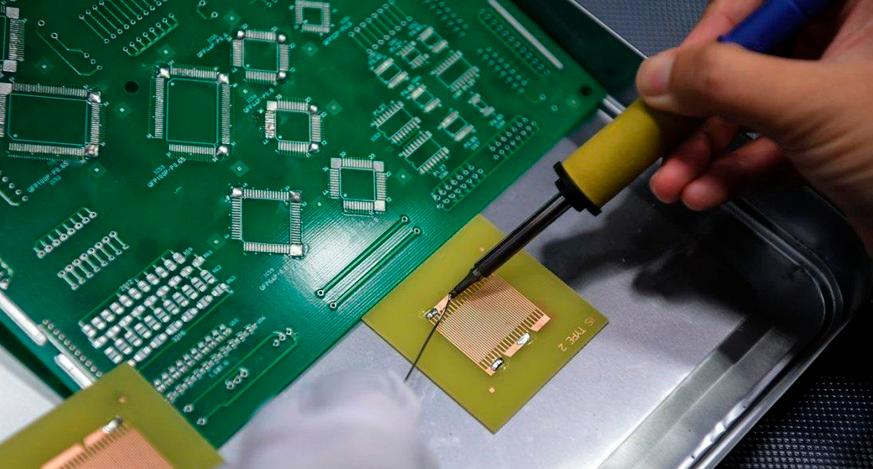

In addition to electrical and electronic (E&E) products, sectors likely to be affected include rubber gloves, semiconductor components, industrial machinery and palm oil derivatives.

Penang Chinese Town Hall president Tan Sri Tan Khoon Hai warned that the sudden move would undercut Malaysia’s cost competitiveness in the US market.

“This move may strain Malaysia-US trade ties and shake investor confidence, especially among foreign investors who use Malaysia as a manufacturing base to access American markets,” he told theSun.

He said exporters risk losing market share to countries such as Vietnam and Thailand, which are not facing similar tariff pressures.

The higher landed cost of Malaysian goods, he added, could price local products out of the US market and divert future investments elsewhere.

Tan highlighted that the E&E sector – Malaysia’s top export to the US – will be hit hardest, with glove and machinery producers also vulnerable due to thin global margins.

Calling for immediate federal action, Tan urged a delay in expanding the Sales and Service Tax and postponement of the electricity tariff hike, warning these would add to producers’ burden. He also suggested Bank Negara Malaysia consider lowering the base lending rate.

He further proposed creating a “tariff buffer fund” offering tax deductions over three to five years for companies importing key machinery.

Tan also called for deeper Regional Comprehensive Economic Partnership integration and proposed transforming Penang into a regional semiconductor hub, backed by university partnerships and a Penang Talent Reskilling Fund focusing on artificial intelligence, green technology and automation.

Senior fellow at the Malay Economic Action Council (MTEM) and executive council member of Dewan Perniagaan Melayu Malaysia Datuk Yazid Othman stressed that the government must confront the reality of shrinking national revenue and act swiftly.

“The government must accept the reality that national revenue projections will decline and respond appropriately by focusing on further strengthening the domestic economy and alternative markets, while at the same time protecting SMEs from becoming victims of dumping of cheap imports,” he said.

Yazid also called for a recalibrated fiscal policy to stimulate economic activity and raise household income.