MALAYSIA’s leading optical retail chain, Focus Point Holdings Berhad, has secured overwhelming shareholder support for two major initiatives designed to reward investors and enhance share liquidity. The company’s Extraordinary General Meeting (EGM) held on July 29, 2025, approved both a substantial 1-for-3 bonus issue and the establishment of a comprehensive Dividend Reinvestment Plan (DRP).

Major Share Expansion Through Bonus Issue

The approved bonus issue represents a significant expansion of Focus Point’s share capital, with up to 153,999,680 new ordinary shares set to be issued. Current shareholders will receive one bonus share for every three existing shares held, potentially increasing the company’s total issued shares from 461,999,041 to an impressive 615,998,721 shares.

This strategic move is expected to enhance trading liquidity and make Focus Point shares more accessible to a broader range of investors. The entitlement date will be announced following receipt of all necessary regulatory approvals, including conditional approval from Bursa Securities.

Flexible Dividend Reinvestment Options

Complementing the bonus issue, Focus Point’s new Dividend Reinvestment Plan offers shareholders unprecedented flexibility in managing their returns. Under this program, investors can choose to reinvest their cash dividends—in whole or in part—into new shares rather than receiving cash payments.

The plan covers all types of dividends, including interim, final, special, and other cash distributions. Importantly, the Board retains discretion over which dividends qualify for reinvestment, ensuring the company maintains financial flexibility while offering valuable options to shareholders.

Leadership Confidence in Strategic Direction

Datuk Liaw Choon Liang, President & Chief Executive Officer of Focus Point, expressed enthusiasm about the initiatives: “These initiatives reflect our commitment to rewarding shareholders while supporting Focus Point’s long-term growth. With the bonus issue enhancing liquidity and broadening investor reach, and the DRP offering a convenient reinvestment option, both initiatives are expected to support the Group’s growth trajectory while delivering added value to shareholders.”

Strong Foundation for Continued Growth

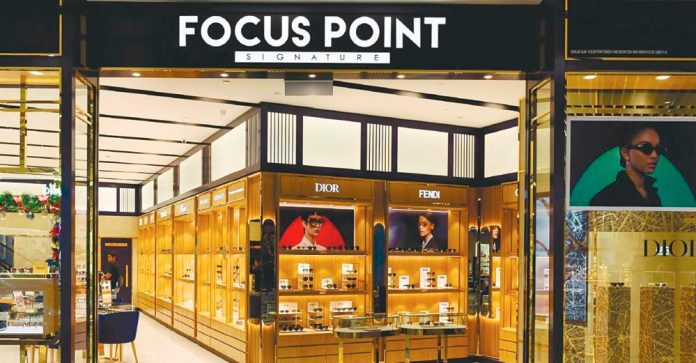

Established in 1989, Focus Point has evolved from a single optical store into Malaysia’s premier eyewear and vision care provider. The company operates an extensive network across Malaysia and the region, offering comprehensive optical brands and services through its retail chain and ExcelView Laser Eye Centre.

Beyond its core optical business, Focus Point has successfully diversified into food and beverage ventures, including the Japanese-concept Komugi bakery launched in 2012 and the HAP&PI frozen yogurt brand introduced in 2024.

The company’s multi-faceted approach to business development, combined with these shareholder-focused initiatives, positions Focus Point Holdings as an attractive investment opportunity in Malaysia’s retail and consumer services sector.

Both initiatives are subject to conditional approval from Bursa Securities and other relevant authorities. UOB Kay Hian (M) Sdn Bhd serves as the Principal Adviser for these corporate exercises.