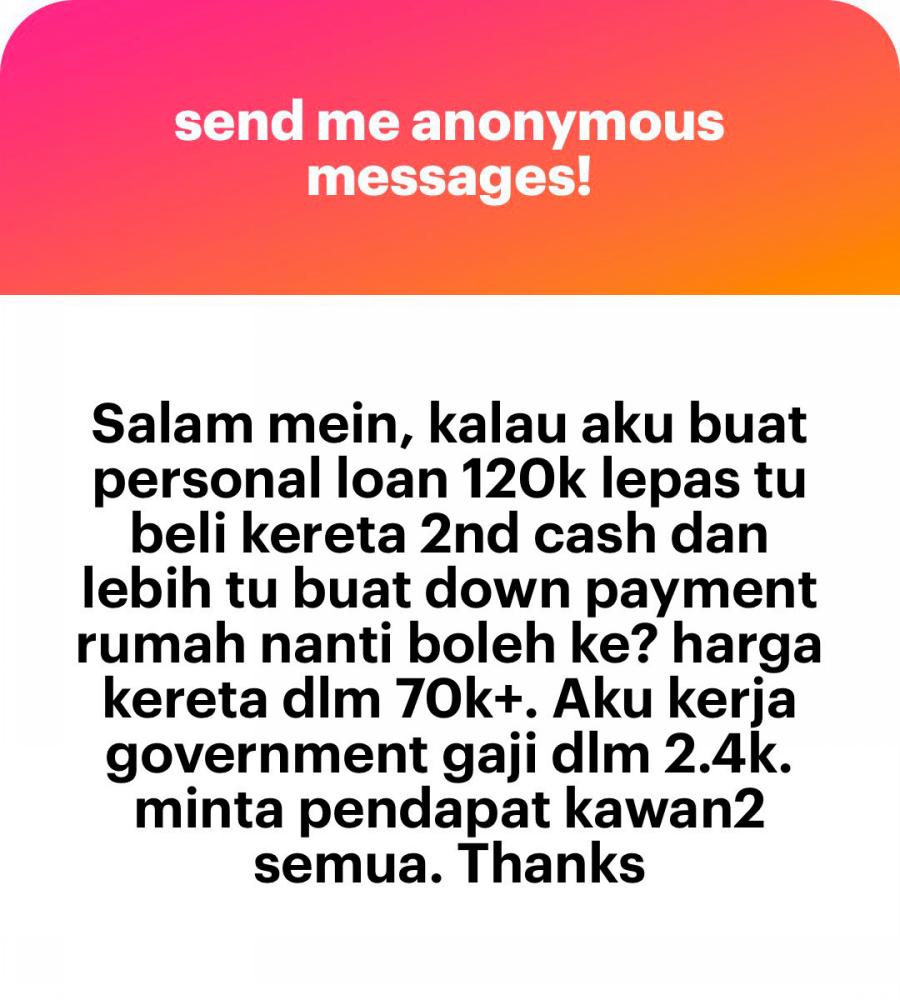

In the post on @meinmokhtar’s X account, the anonymous person asked the admin and Malaysian netizens if he should take the RM120,000 loan to purchase a RM70,000 secondhand car in cash and use the leftover funds as a downpayment for a house.

He added that he works as a civil salary and earns a monthly salary of RM2,400.

“Hi, if I take a personal loan RM120,000 and after that, buy a secondhand car in cash and then use the rest of the money for a house downpayment— is that possible?

“The price of the car is around RM70,000. I work in the government with a salary of RM2,400. Would like to get the advise of everyone. Thanks.”

The post has since amassed more than 80,000 views and more than 100 comments from Malaysian X users advising him to cut his coat according to his own cloth or he may suffer in the future.

“Anon, take it slow when starting your life. Rushing to get a luxury car, who’s the house for? Just get a cheaper car first. With that 2.4K, you can only afford an Axia. Hold off on buying a house for now. Work for 3-4 years first. Don’t start your life with debt,” advised @binikhrul.

Some even shared their own personal experiences taking up personal loans and regretting it after.

“I already feel regret sometimes about taking out a personal loan of RM10,000. Now, RM120,000 You’re absolutely crazy, anon,” commented @ManikLalabuci.

ALSO READ: M’sian earning RM5k racks up RM20k in credit card debt

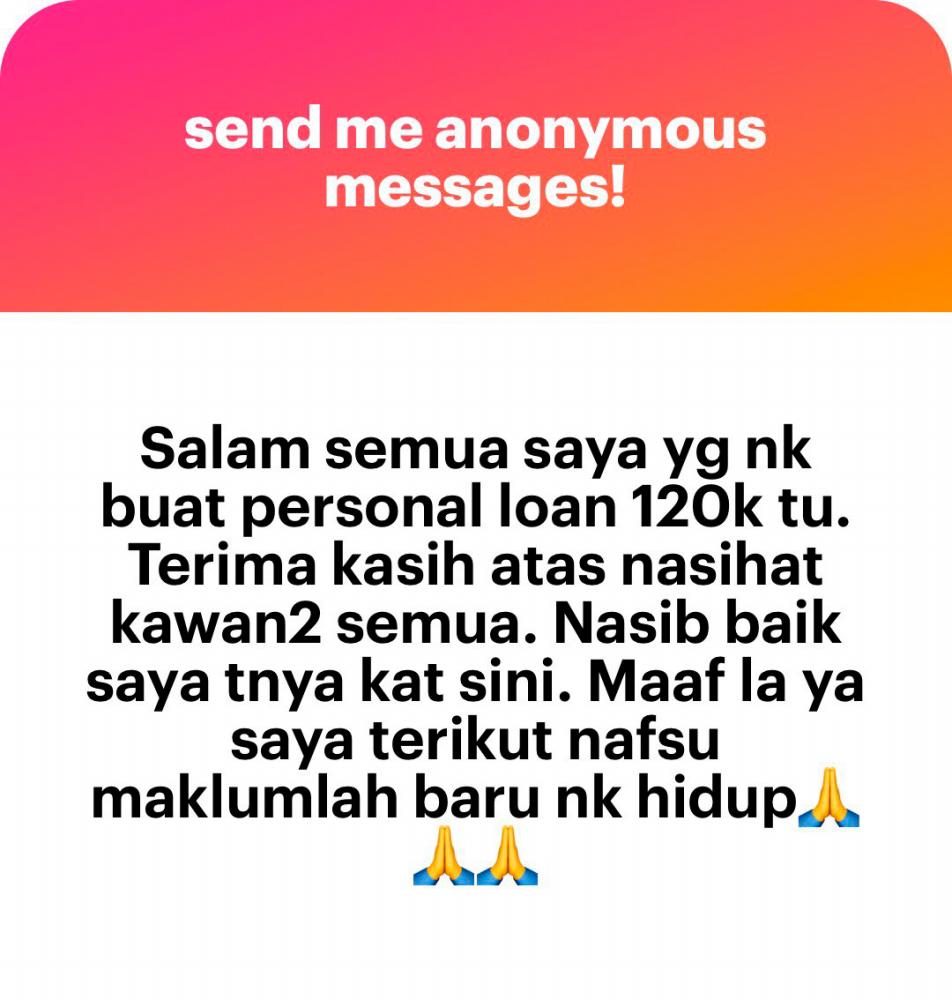

Shortly after, the person returned with another post, thanking netizens for their advise.

“Hi everyone, I am the one who wanted to take the RM120,000 personal loan. Thank you for all your advise.

“Luckily I asked here. Sorry, I followed my whims and fancy, especially since I am just starting out in life.”