IT is not easy to accumulate significant retirement savings early in life, especially after just a decade of working, but one Malaysian suggests it is possible with the right strategies and dedication.

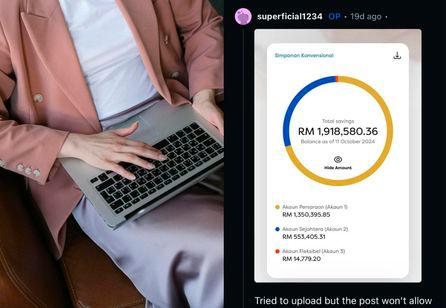

A 35-year-old woman, who identifies herself as an engineer on the MalaysianPF subreddit, claims she will reach RM2 million in her Employee Provident Fund (EPF) savings by year-end, suggesting that career focus and discipline can outweigh the need for multiple income streams.

In her post dated October 11, which has been deleted, the alleged mid-level manager started with a salary below RM5,000 and reportedly now earns around RM50,000 monthly with claimed annual bonuses between RM200,000 to RM300,000.

She stated that her EPF contributions, including self-contributions and dividends, reached nearly RM400,000 last year.

“I’m posting this to show that just doing well at your 9-5 job is enough to retire comfortably.

“Rather than diverting my attention to other things, I focus on being really good at my job,“ she wrote.

The poster described her strategy, which reportedly includes maximising the RM100,000 annual self-contribution limit and maintaining all EPF savings intact.

“I have not touched my EPF at all even though I can technically withdraw anything above 1 mil,“ the post read.

She claimed the compounding effect accelerated her wealth accumulation, taking ten years to reach her first million but only three years for the second.

“My dividend alone was RM80,000 last year, and this will just keep growing,“ she added.

The supposed engineer attributes her reported success to company loyalty and performance, claiming rapid promotions within the same organisation since graduation.

“My increment since then has been huge. I hit RM20,000 salary within 5 years of working,“ the post continued.

While acknowledging receiving a property gift from her parents, she maintains her financial achievement is self-made.

“If you can be really good at what you do, you will be paid lucratively,“ she advised, suggesting that professionals in various fields could achieve similar results through excellence in their primary careers.

The post sparked widespread discussion on X, where it was shared by Kewangan Graduan on October 30.

Some users were impressed by her financial discipline and success. For instance, @pwaizer commented, “50k at 35, with the same job since graduation, she must be earning in foreign currency. So no need to even reach the C-suite level.”

Others expressed curiosity about her career path, with @deejaemma asking, “What job title and what industry? Asking for myself,” while @mingum19 remarked, “She might earn a salary in US dollars, there are many companies here that pay overseas salaries, good for her!”

Some saw her achievements as possible but attributed it to working in a multinational company (MNC). @reinerbraunnn speculated, “So this is considered lucky for her to work in this company. For a normal Malaysian company, promotions normally don’t go above 1k adjustment. With 50k at 35 with a bonus of 200k, I reckon it’s an MNC company.”

However, not all comments were supportive. Some netizens found her story unrelatable. @azharokey remarked, “50k salary, EPF contribution almost 100k, people like this are not suitable in giving financial advice.”

Another user, @SuduKicapTomato, felt similarly, saying, “Good motivation, but realistically, most average earners can’t relate to RM50k monthly and RM100k bonuses. Not exactly the norm.”

Others criticised the tone of the post. @arifazmi48 was blunt: “Talking about a 50k salary. Getting a bonus that goes straight into EPF. Try talking from a B40 perspective if you want to inspire people. This kind of talk is just nonsense.”

Likewise, @fentapropo_roc remarked, “Trying to be motivational... and then you see a 50k monthly salary?? That’s more like showing off. ‘Normal people’ can’t relate.”

The comments reveal a divide between high-income earners and the average Malaysian worker, highlighting how different income levels shape perceptions of financial advice and what is achievable in personal finance.