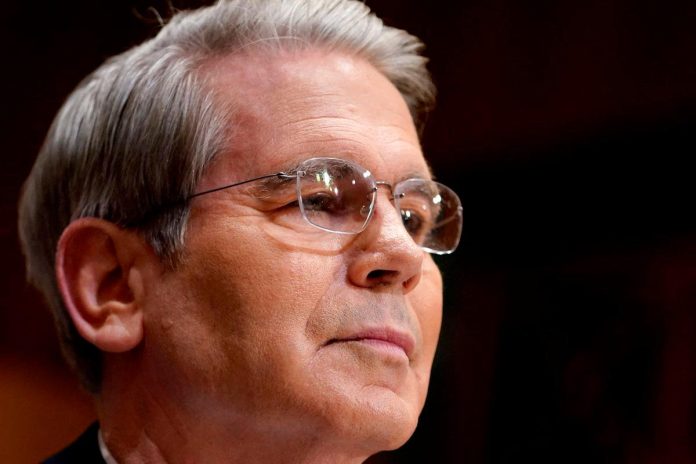

WASHINGTON: US Treasury Secretary Scott Bessent called Monday for the Federal Reserve to conduct an “exhaustive internal review of its non-monetary policy operations,“ accusing the central bank of “significant mission creep.”

In a lengthy post on X, Bessent sought to clarify remarks he made in a CNBC interview earlier in the day, in which he said “what we need to do is examine the entire Federal Reserve institution and whether they have been successful.”

The remark came in response to being asked about firing Fed Chair Jerome Powell, whom President Donald Trump has repeatedly attacked in recent weeks for not cutting interest rates.

The White House has said that Trump has no plans to fire Powell ahead of his term’s end in May 2026 — a legally contentious move that would bring into question the Fed’s independence.

However, Trump and other Republican allies have recently zoomed in on the Fed’s $2.5 billion headquarters renovation project as a possible avenue for his ousting.

Bessent, in his post on X, said that the Fed’s “independence is a cornerstone of continued US economic growth and stability.”

“However, this autonomy is threatened by persistent mandate creep into areas beyond its core mission,“ he said, without specifying which policy areas.

He called for a review of the over-budget renovation project, while noting he has “no knowledge or opinion on the legal basis for the massive building renovations.”

Bessent did not comment Monday on a Wall Street Journal report over the weekend that he had privately set out his case to Trump for why the president should not try to fire Powell.

The Journal reported that Bessent’s reasons focused on issues including effects on the economy and markets, alongside the likely political and legal obstacles Trump would encounter.

Bessent told CNBC there has been “very little, if any, inflation” from Trump’s wide-ranging tariffs so far, and suggested that central bankers appear unable “to break out of a certain mindset.”

Since returning to the presidency in January, Trump has imposed a 10 percent levy on goods from nearly all trading partners, with higher rates separately on imports of steel, aluminum and autos.

While the effects on consumer inflation have been muted so far, given that Trump has backed off or postponed the harshest among his proposed measures, economists expect that data over the coming months will give a better idea of the tariffs’ impact. – AFP