This live report has ended. Thank you for following our live coverage.

• An additional 50 percent tax deduction on cost expenses involving capacity development and software procurement incurred by employers in implementing flexible work arrangements; and a 50 percent tax deduction for additional care paid by the employer up to 12 months for employees who are caring for their sick children, family members or the disabled. Read here.

• Government urges 39 listed companies under the top 100 listed companies in the Bursa Malaysia to ensure 30% female board representation by the end of 2027.

• Civil servants, especially retirees above the age of 65 who are undergoing treatment at the National Heart Institute (IJN), can continue with their treatment.

• To encourage first-home ownership, tax relief of up to RM7,000 ringgit will be given for homes costing up to RM500,000 while RM5,000 in tax relief for homes costing between RM500,000 to RM750,000. The exemption can be claimed for three consecutive assessment years and applies on the sale and purchase agreement completed between January 1, 2025 to December 31, 2027.

• Combined quantum for the Rahmah Cash Aid (STR) and the Rahmah Necessities Aid (Sara) will increase to RM4,700 next year.

• Poor senior citizens will receive up to RM10,000 instead of RM8,000.

• 4.1 million households will receive Rahmah Necessities Aid (Sara) of RM100 per month starting April next year.

• Single individuals, meanwhile, will receive RM600 in Sumbangan Tunai Rahmah (STR).

• Excise duties on sugary drinks will go up gradually, starting with a 40 sen increase on January 1 with additional funds will be used to fund public health, including diabetes treatment centres

• EPF to look into methods to transfer savings between next-of-kin.

• All migrant workers are required to become EPF contributors.

• Tax relief on premiums for private retirement schemes is also being extended to 2030.

• RM4 billion will be allocated for scholarships with GLICs and GLCs committed to ensuring 50 percent of scholarships are given to lower and middle-income families.

• Tax relief for parents contributing to the National Education Savings Scheme (SSPN) will also be extended for another three years.

• RM635 million is being allocated for maintenance and repairs at public varsities and expanding internet access.

• RM2 billion allocated for upgrades and maintenance of school nationwide; RM1 billion for the maintenance involving all types of schools; RM1 billion to upgrade the poor infrastructure in 543 schools, mainly in Sabah and Sarawak.

• Education Ministry receives highest allocation in history; from RM58.7 billion this year to RM64.1 billion for 2025.

• Tax exemption on overseas-generated income that has already been subjected to income tax from the source country to be extended until December 31, 2036.

• Individual income tax exemption for medical expenses up to RM10,000 which covers the portion of medical payments made under insurance, medical and health takaful products under co-payment scheme.

• Government announces income tax exemption increase for individuals on premium payments for education insurance and medical insurance increased up to RM4,000.

• The government allocates RM130 million to the Indian community to preserve their human capital, social and community welfare by implementing various programmes including business financing.

• Government sets minimum wage at RM1,700 from RM1,500 previously; to take effect from February 1, 2025. Read here.

• To preserve Kuala Lumpur’s status as a cultural and creative city, Khazanah will allocate RM600 million to restore as well raise the value of the Sultan Abdul Samad Building and Carcosa Seri Negara. This includes building a multi-storey bridge connecting Taman Botani Perdana with Carcosa Seri Negara.

• Government allocates RM550 million for Visit Malaysia 2026 with RM110 million allocated to enhance tourism spots, establish ecotourism cooperation and support UNESCO nomination

• The government plans to provide logistic companies that conduct smart logistics complex activities an investment tax allowance at 60% for the next five years to ensure the logistic industry capacity is increased through the adaptation of IR4.0 technology.

• Malaysia’s trade volume between Jan and Aug 2024 soared 10.2 percent to RM2.14 trillion. The country also recorded a surplus of trade for 53 consecutive months since May 2020.

• Malaysia has secured investments amounting to US$16.9 billion for the period up to 2038 from the global technology giants AWS, Microsoft, Google and Oracle

• KWAP under its pilot fund will provide RM1 billion to also support the activities of local start-up companies with RM200 million allocated specifically for 2025.

• National Fund-of-Funds (NFOF) will be established under Khazanah which will commence operations next month with a fund of RM1 billion to support venture capital fund managers to invest start-up companies; RM300 million allocated for 2025.

• Khazanah to provide RM1 billion to lead investments that support the local semiconductor industry.

• The Retirement Fund Inc (KWAP) via its RM6 billion stimulus fund will strengthen the local private market including private equity, infrastructure and real estate.

• Government-Linked Investment Companies (GLIC )through its GEAR-uP initiative will increase direct investment in the country amounting to RM120 billion for a five-year period with RM25 billion allocated next year.

• The government to allocate more than RM250 million to repair slopes nationwide; RM21 million to prevent sinkhole issues in Kerian Laut, Perak, Kedah and Perlis; RM10 million to carry out structural geotechnical studies and soil layers throughout the main streets within Kuala Lumpur’s Golden Triangle

• In line with the enactment of the Cyber Security Act 2024, the National Cyber Security Agency (NACSA) will be equipped with an additional 100 staff along with a RM10 million allocation.

• A National Fraud Portal has been launched in an effort to combat online fraud. The portal facilitates the detection of suspicious transactions automatically.

The government allocates RM20 million towards the role of the National Scam Response Cente (NSRC) to increase its functions and effectiveness. Read here.

• This includes RM20 million for the bipartisan All-Party Parliamentary Group Malaysia Sustainable Development Goals, as well as funds to empower the Public Accounts Committee (PAC) to check and balance the government

• Parliament will receive a budget of RM180 million in 2025, up from RM166 million last year.

• The Malaysian Anti-Corruption Commission (MACC) to receive RM360 million in allocation for 2025 compared to RM338 million this year

• From 2025, the government plans to double the special grant rate for Sabah and Sarawak to RM600 million. Read here

• Allocations for the development of Sabah and Sarawak continue to be a priority and are the highest among the states at RM6.7 billion and RM5.9 billion respectively. Read here.

• The 2025 Budget allocates a total of RM421 billion, comprising RM335 billion as operating expenditure and RM86 billion as development expenditure, not including RM2 billion in contingency savings. Read here.

• Sales and Services Tax (SST) to be progressively expanded beginning May next year.

• The government will also impose a dividend tax on individuals for dividends exceeding RM100,000. The dividend tax will begin for the 2025 tax assessment year.

• Malaysian Competition Commission (MyCC) to receive RM27million to combat cartels aiming to monopolise the economy

• The government plans to implement targeted subsidies for those using RON95 petrol by the second quarter of 2025.

• This year’s revenue collection is again projected to be higher at RM322 billion instead of the projected RM308 billion.

• The government also expects the 2025 revenue collection to rise to RM340 billion.

• The country’s total debt last year stood at RM1.2 trillion or more than 64 percent of the GDP. Including liabilities, the debt level has reached RM1.5 trillion ringgit or 80 percent of GDP.

4.20pm: In his speech, Anwar, which also touched upon the domestic economy, Anwar mentions that in August 2024, the inflation rate was only 1.9%, among the lowest in the region.

As of the same month, the unemployment rate also went down to 3.2%, the lowest since January 2020.

Government revenues for 2024 are expected to increase from RM329.5 billion this year.

4.15pm: In the opening to his Budget speech, Anwar announced a RM5.5 million allocation for upgrade and repair works of the iconic Siti Khadijah market in Kota Bharu, Kelantan.

4.06pm: Anwar Ibrahim has begun tabling Budget 2025 in the Dewan Rakyat.

3.40pm: Anwar arrives at the Parliament building

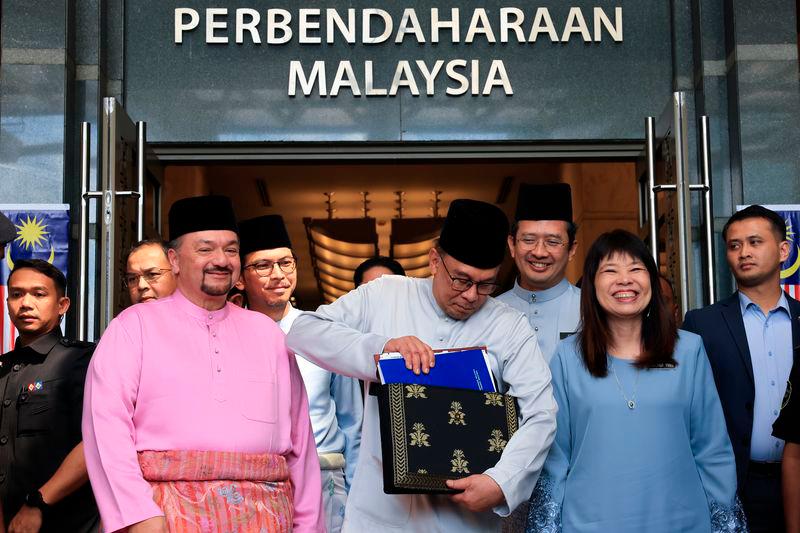

3.15pm: Anwar Ibrahim dressed in a white-coloured Baju Melayu prepares to leave the Finance Ministry for Parliament, where he will be tabling the Malaysia Madani 2025 Budget at 4pm.

2.45pm: Prime Minister Datuk Seri Anwar Ibrahim has arrived at the Finance Ministry (MOF) headquarters ahead of tabling of the Budget 2025 at Dewan Rakyat this afternoon.

Prime Minister Datuk Seri Anwar Ibrahim will table Budget 2025 in Parliament at 4pm.

Themed ‘Ekonomi MADANI, Negara Makmur, Rakyat Sejahtera’, this will be the third budget under the MADANI government led by Anwar and the last under the 12th Malaysia Plan (2021-2025) before transitioning to the 13th Malaysia Plan for the next five years.

The Finance Minister had previously said Budget 2025 aims to improve the living standards of the people and advance the nation’s development.

Stay tuned to this live report and our social media channels - X, Instagram, Telegram as we bring all the relevant developments and updates on the Budget 2025.

Meanwhile, here is what can you expect from Budget 2025:

Anwar: Budget 2025 to address inflation, boost wages: The MADANI government will address the issue of inflation in Budget 2025. Read more here.

Budget 2025 - Educators call for quality infrastructure, support: The enhancement of digital education through the Ministry of Education’s Digital Education Policy is a major expectation for educators in Budget 2025. Read more here.

Budget 2025: MOSTI proposes more R&D allocation: The Ministry of Science, Technology and Innovation (MOSTI) is proposing an increase in allocation for research and development (R&D) under Budget 2025, said its minister Chang Lih Kang. Read more here.