WOULD you take a loan for your family members to purchase a car?

It would be a sound plan if you have the financial means in case your family members suddenly find themselves in a situation where they are unable to pay for the car.

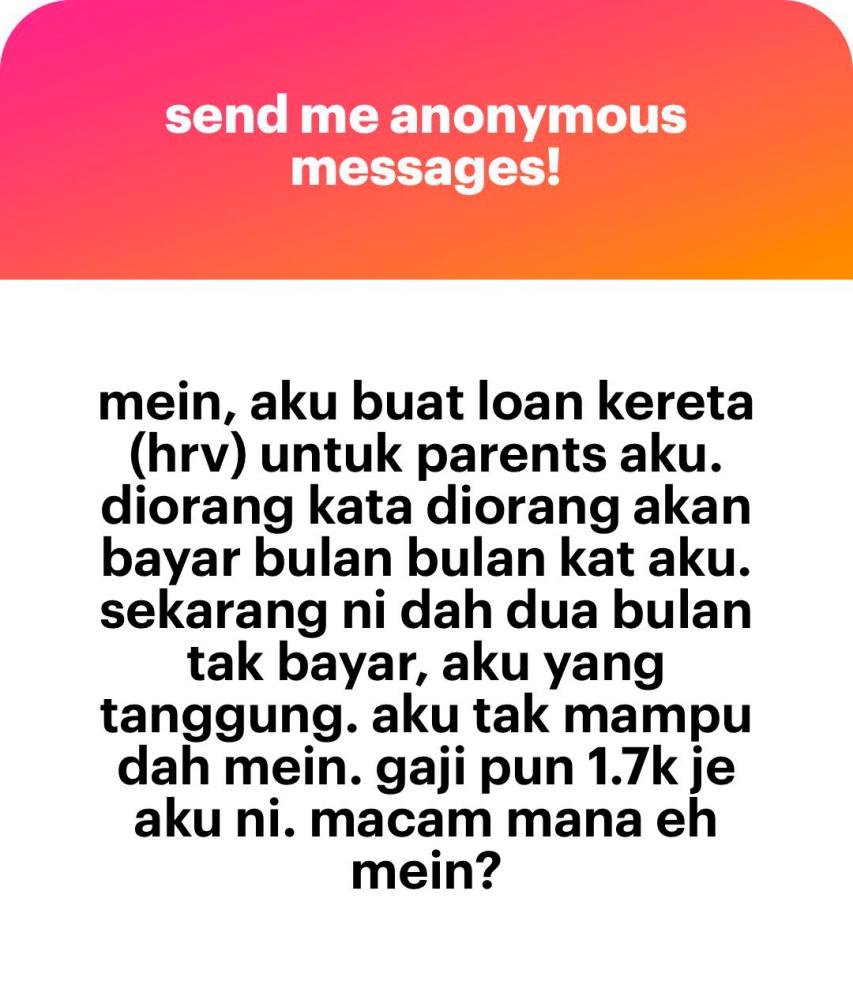

An anonymous Malaysian took to @meinmokhtar on X to share how he has landed himself in hot water after his parents were unable to pay for the car loan which he had taken for them.

In the post, he explained that he had taken a car loan for a HR-V for his parents who promised that they would give him the money for the monthly car loan payments.

However for the past two months, they have not been giving him the money and he has been forking out the money for the payments.

“I took a car loan for my parents.

“They said they would pay me on a monthly basis.

“Now it’s been two months that they haven’t paid for it and I have to be the one to settle it.

“I can’t afford it anymore.”

To make matters worse, he shared that he only earns a salary of RM1,700.

“What do I do?” he pleads at the end of his post.

The post has since attracted many netizens who were surprised that he got himself into such a predicament.

“Anon, didn’t you read the advice people gave before about not taking a car loan for your family?

“Talk to your family, and if they still don’t pay by the end of the month— you need to sell the car.

“For the remaining loan balance, go to AKPK and ask for assistance to settle it,” advised Ooi Beng Cheang.

“You bought it first, then asked for advice?

“That’s just lacking foresight, Anon. Ideally, you should’ve thought through at least three possible outcomes before making the purchase.

“The best option now is to just sell the car. If not, take it from your parents and use it yourself.

“Your parents, acting all high and mighty, wanting an HR-V but not wanting to pay for it? Unreal,” commented Mial.

A few netizens also questioned how he managed to get a RM100,000 car loan with a RM1,700 salary. While a few others shared that he might not have any other commitments or would have taken a loan for a secondhand HR-V.

“Question: How can you get a 100k car loan with a 1.7k salary? It’s strange that the bank approved it. The monthly payment alone is over a thousand,” said @GoodnightNero.

“It’s probably an older, used HR-V model. A new one would be highly unlikely, as loans over RM100,000 seem impossible to approve on a 1.7k salary,” commented Adzim.

ALSO READ: 33 year old M’sian blames father for bankrupting them at the age of 23