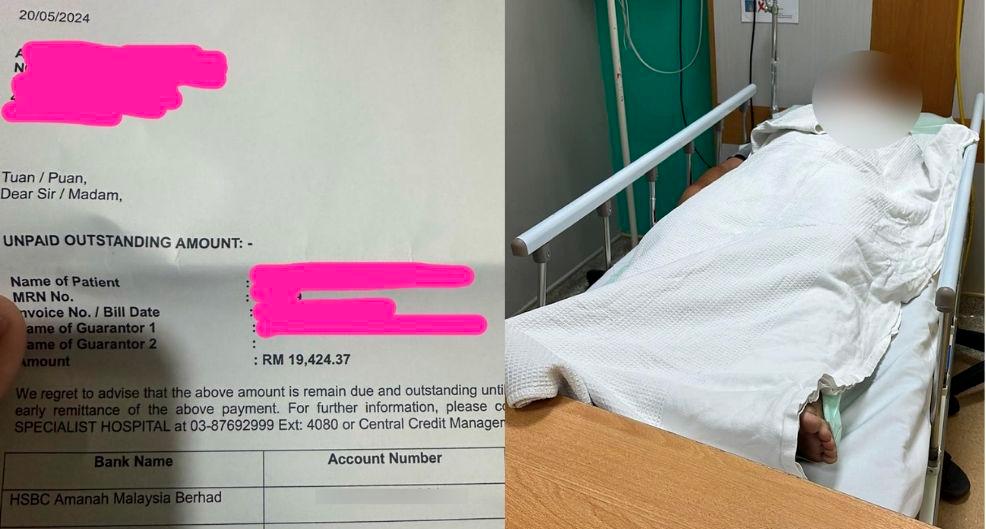

A woman recently called out a well-known insurance company for allegedly not covering her husband’s medical bills totaling over RM19,000 despite receiving payments for nearly five years. .

In a Facebook post by Acha Natasha, she said her husband was using his medical insurance for the first time for his treatment back in May.

“My husband had an accident and fell from the first floor. We then headed to (Kajang Specialist Hospital) for further treatment,” she said in her post.

Upon arrival at the hospital, the guarantee letter (GL) requested by the hospital had been approved beforehand hence her husband had been admitted but after several medical tests confirming a spinal fracture and “irregular” blood pressure, the doctor requested to amend said GL.

“While he was warded in the hospital, the hospital requested three GLs from the insurance company and all of them were approved,” she mentioned, adding that the hospital required a RM400 deposit in case there is any treatment the insurance does not cover.

ALSO READ: M’sian working in S’pore has troubles paying RM 16k hospital bill

However, things took a turn for the worst as the hospital informed Natasha’s husband that all the final GLs were declined by the insurance company together with the company asking the hospital to amend their report.

“The hospital did what (the company) asked for three times but was still rejected

“We came to the hospital to receive treatment not to be trapped in unsolicited debt,” she added.

According to Natasha, the reason the insurance company gave was that her husband’s treatment can be done as “outpatient” but seeing as he was involved in an accident, she took further action and collected all the necessary documents with her insurance agent and submitted it to the company.

The insurance company was allegedly unresponsive to her emails and phone calls on top of receiving the same reply from customer service. Not only that, the hospital even sent a lawyer’s demand letter to claim the bill but the company remained unresponsive.

However, another update stated that the insurance company got back to Natasha after her post online circulated and has since asked for 10 days to look into the issue.

ALSO READ: Patient in China charged RM4 seating fee by hospital